Equity Tracker

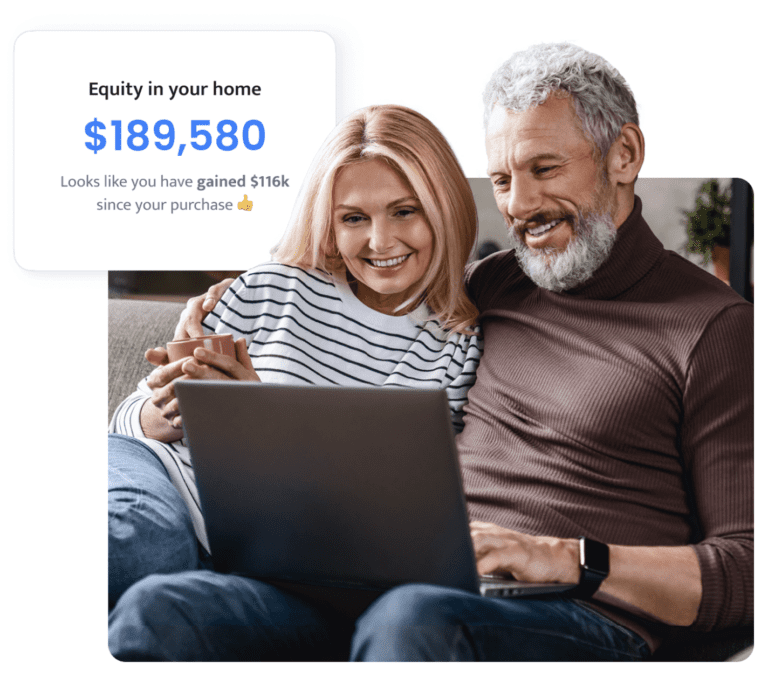

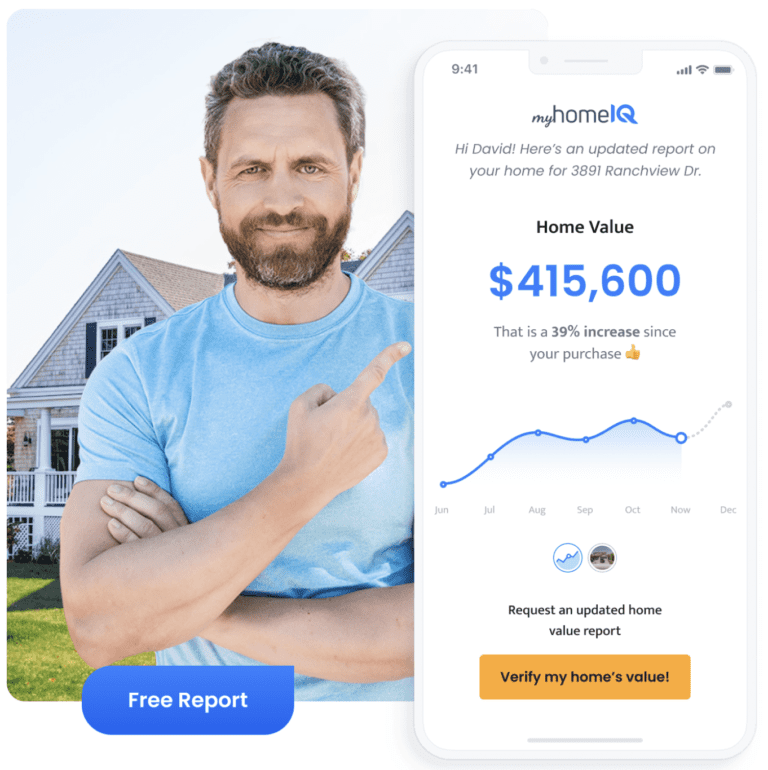

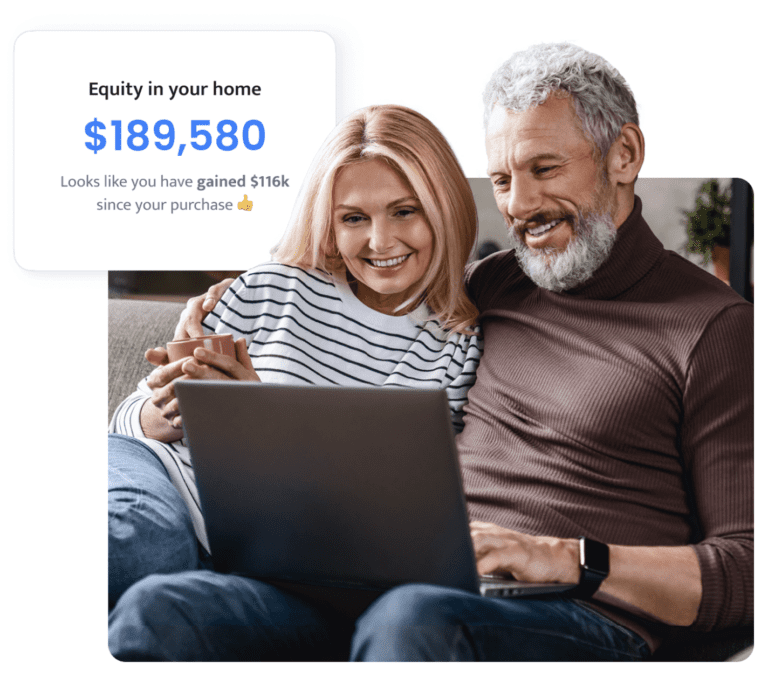

For most people, a home is their largest asset and accounts for over 80% of wealth at retirement. Receiving an accurate home valuation is important if you ever want to sell, refinance or borrow against your home’s equity

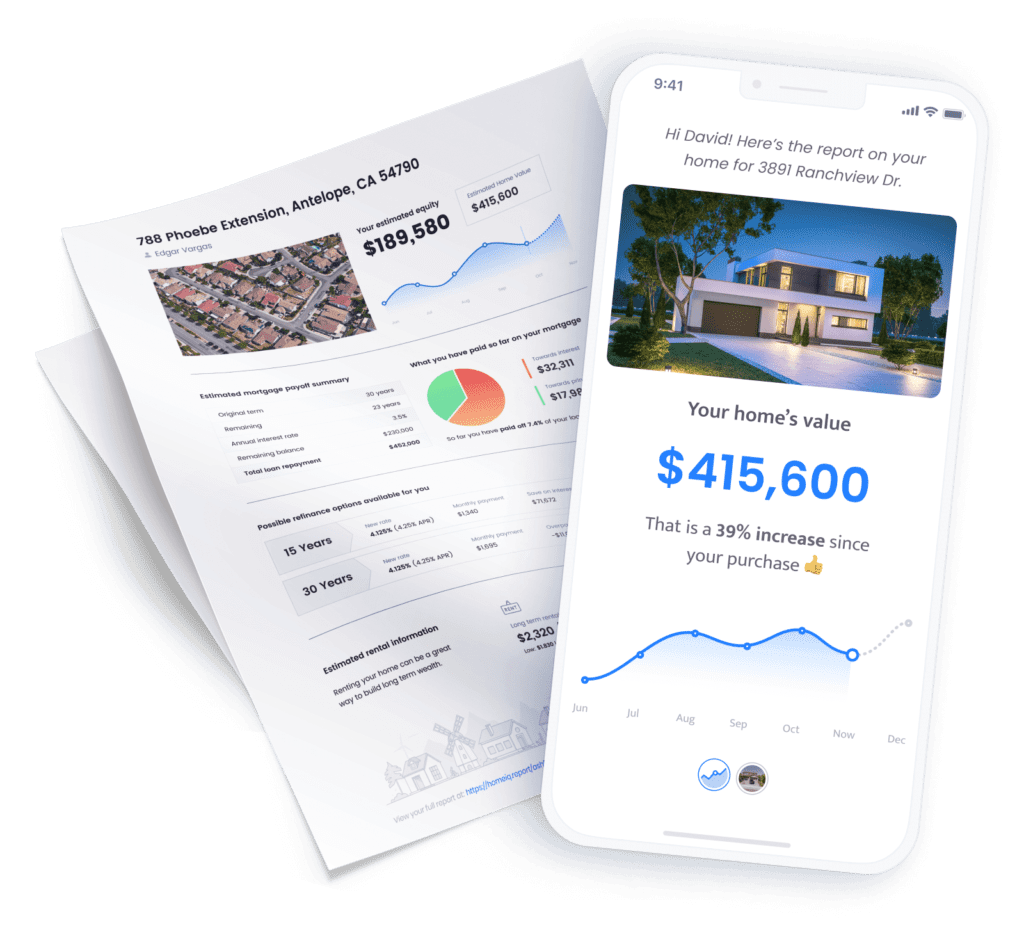

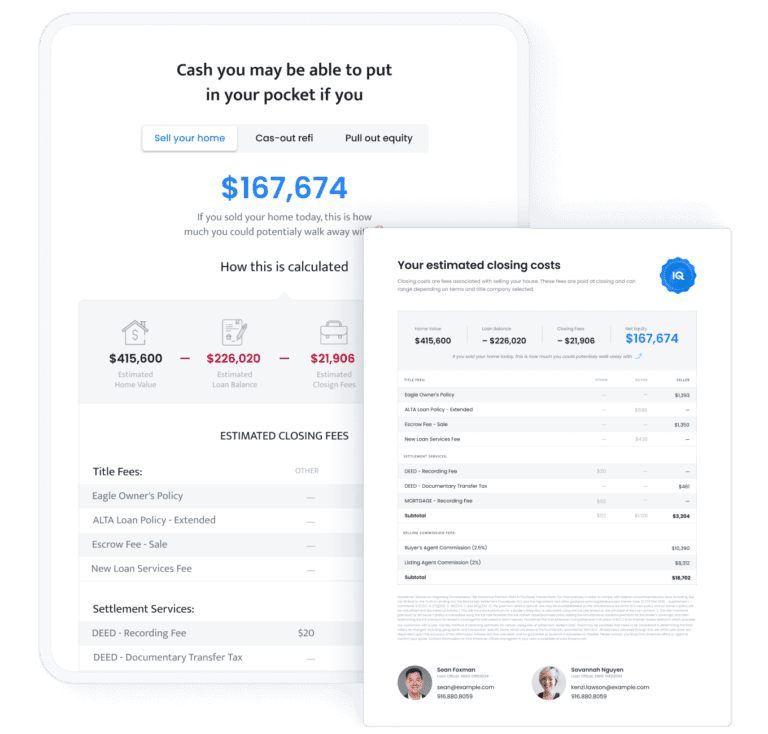

Instantly receive a detailed home analysis report to understand all your options as a homeowner, including the true cost of selling a home in todays market.

Provide an address so we can analyze your home value and loan information

Verify your current home and loan information to ensure an accurate report

Receive a pdf report along with unlimited access to an online home portal

Whether you’re buying or selling, a home value estimate gives you insight into what you could gain financially and helps you form a strategy for moving forward.

For most people, a home is their largest asset and accounts for over 80% of wealth at retirement. Receiving an accurate home valuation is important if you ever want to sell, refinance or borrow against your home’s equity

Net sheets on demand. Know what each transaction will net you so you can make the right move when ready.

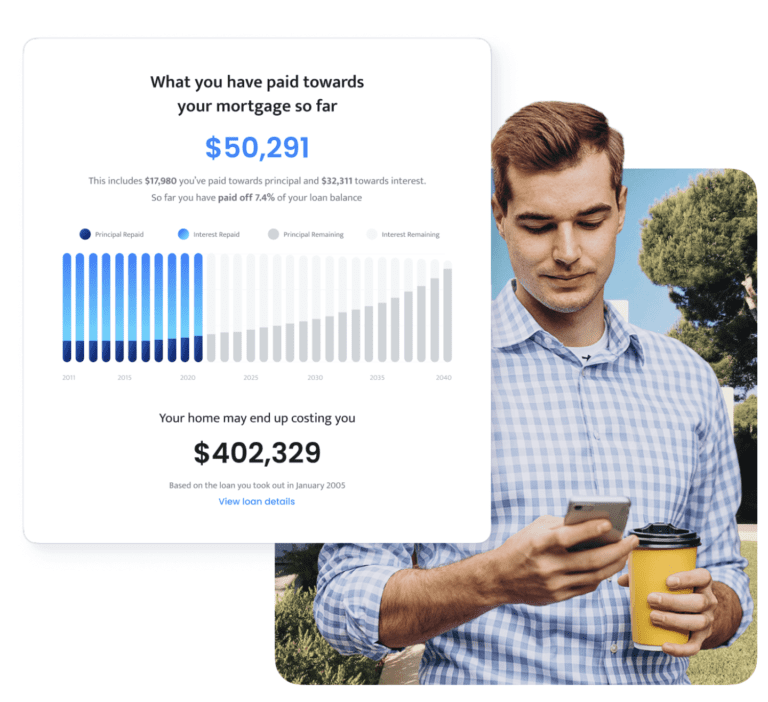

A timeline of your interest paydown and how the payment affects the principle balance over the life of your loan.

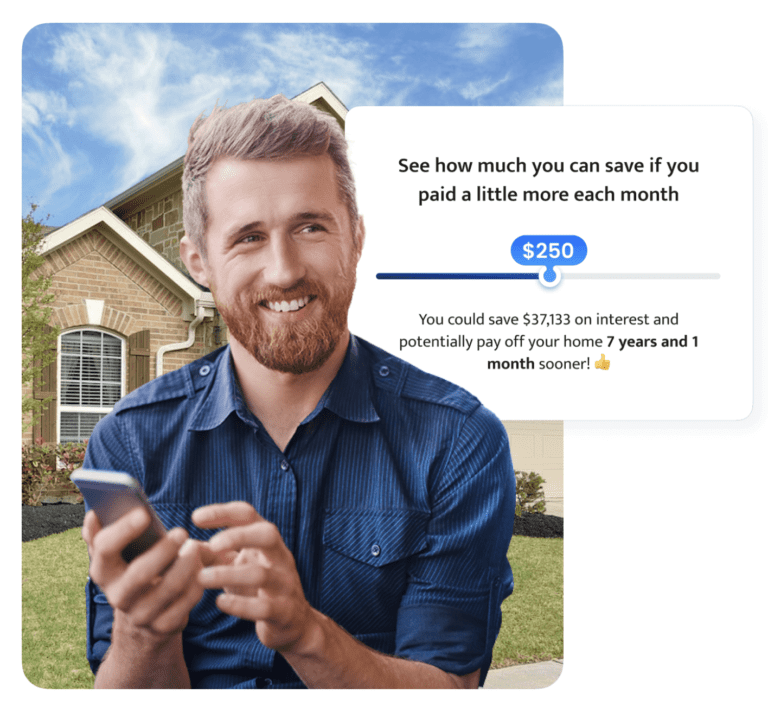

This tool allows you the ability to see how paying more towards your balance might affect your loan payoff and interest savings.

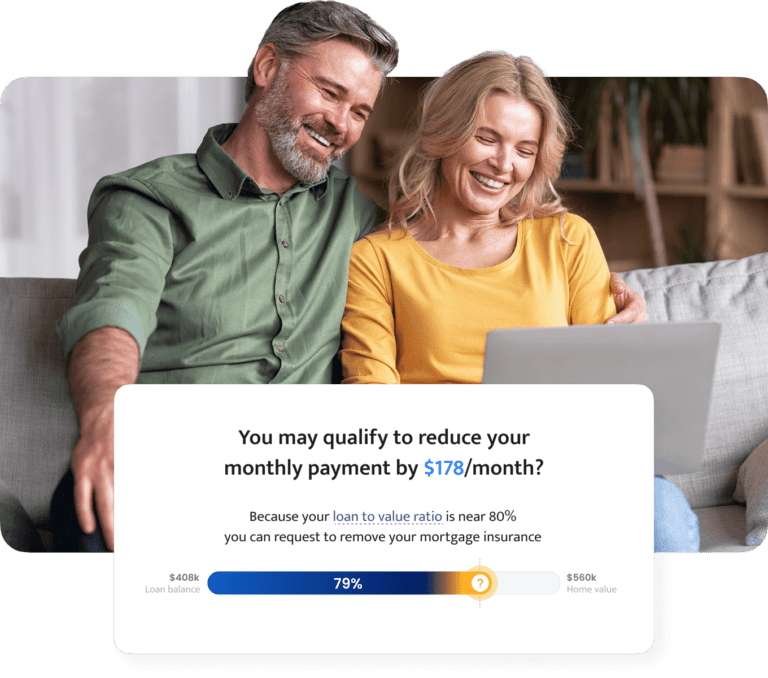

Know when or if you qualify to remove your PMI or MIP.

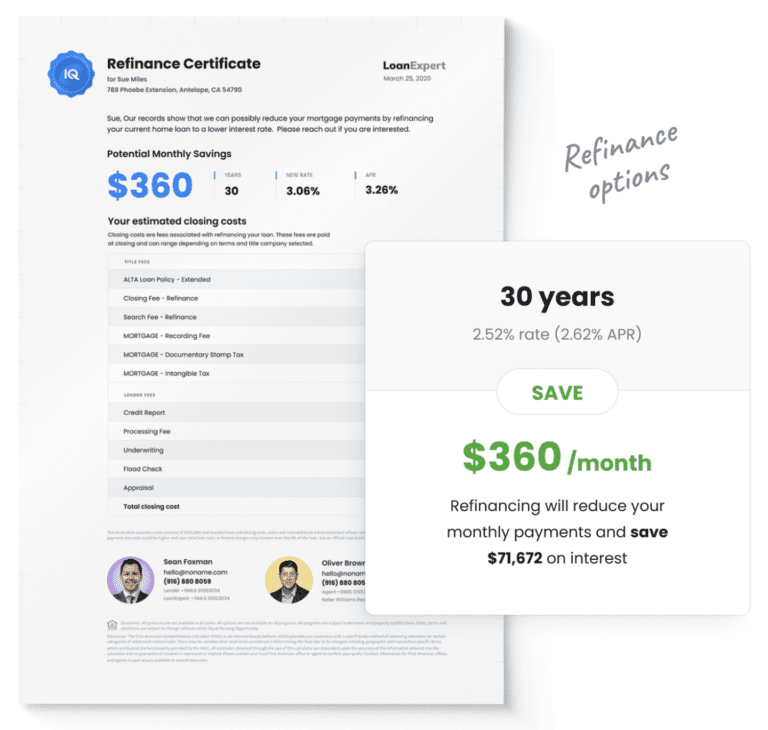

Know about potential refinance opportunities available for your loan and help you save money.

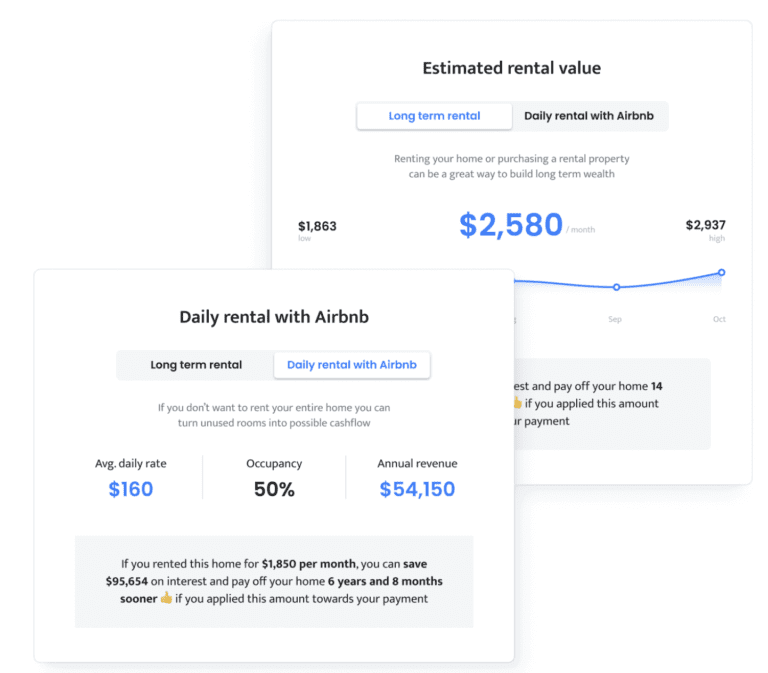

If you want to turn your property into an asset we show you an estimate of the possible rental value and how that asset might perform.

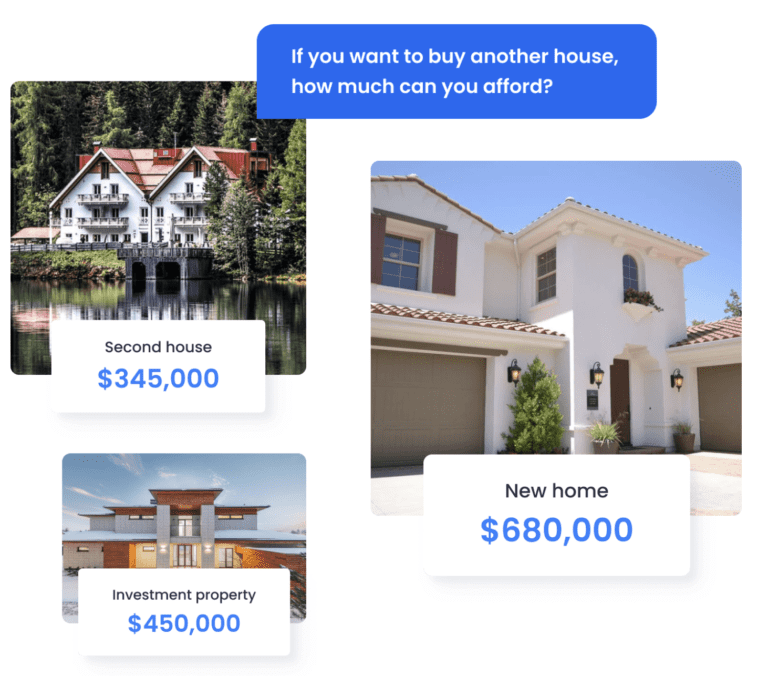

Know what you can potentially qualify for if you used the equity in your home as a downpayment towards another property.

Whether you just prefer a friendly voice or need more information, our licensed real estate professionals are ready to guide you.

Edge Home Finance Corp, is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. Edge Home Finance Corp is a licensed mortgage broker in the following states CA, CO, FL, MN, NC, ND, WI and TX. The following states require disclosure of licensing information. (If your state is not listed, it does not require a specific license disclosure):

CALIFORNIA – Licensed by the Department of Business Oversight under California Finance Lenders Law

COLORADO – Edge Home Finance Corp, 4530 W 77th St Suite 365 Edina, MN 55435, (763) 219-8484; to check the license status of your mortgage broker, visit http://www.dora.state.co.us/real-estate/index.htm

TEXAS – CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV

Your information will be used for the sole purpose of providing your home report.

Your information will not be sold to any party outside of this product.

Opt Out At Anytime