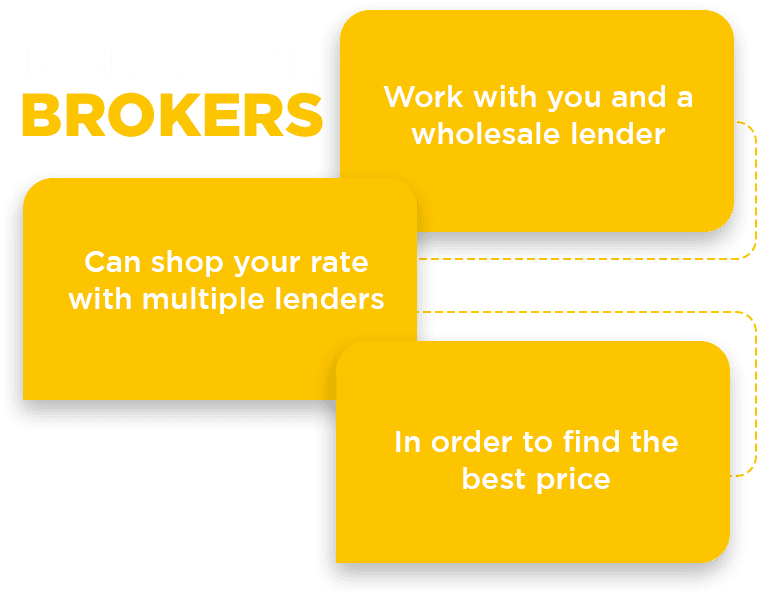

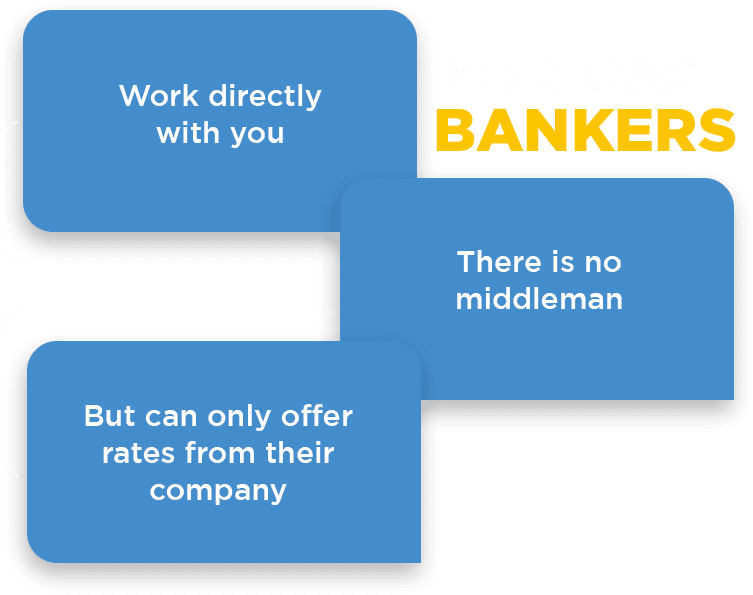

There are mortgage brokers, who work as middlemen between banks/mortgage lenders and borrowers on the wholesale end to secure financing for homeowners. And there are banks/lenders that work directly with

homeowners to provide financing on the retail level, known as consumer-direct lending.

Mortgage brokers are a big part of the mortgage business. Brokers serve an important role in the industry, and can be quite beneficial for both prospective homeowners and those looking to refinance a mortgage.

Borrowers who have trouble qualifying for a mortgage or need to finance tricky deals will often get turned away at the big banks that don’t necessarily specialize in home mortgages.

So for these people, using a mortgage broker is often the best option.

Brokers typically have access to far more loan products

and types of loans than a large-scale bank, whether it’s FHA loans, VA loans, jumbo loans, a USDA loan, or even a self-employed bank statement loan.

An institution like Bank of America might only offer

conventional mortgages, such as those backed by Fannie Mae and Freddie Mac.

If you go with a broker, you might wind up with a more

personalized loan experience, where they can carve out solutions to your problems, whether it’s a low down payment, limited credit history, or the desire to limit closing costs and/or avoid mortgage insurance.

You might feel a bit more involved in the mortgage process versus using one of the big financial institutions out there, though not everyone wants to speak to a human being, or see them face to face.

The application processes might also be quite different. A big bank might just tell you that your credit score is too low, whereas a broker may explain how credit scoring works.

Then make recommendations like paying off some credit cards or student loans to make you eligible in the future.

The takeaway is that a big bank probably won’t go the extra mile for you, whereas the broker might find solutions if/when any roadblocks present themselves.

And part of the reason is because a broker can turn to different lending partners, whereas a bank is at the mercy of its single suite of loan programs. They can’t shop your loan elsewhere.

So for someone who might need a helping hand, or simply wants more attention, a mortgage broker usually is the better option.

Brokers can offer lower mortgage rates in most cases.

Wholesale rates can actually be much cheaper than retail interest rates you’ll get with banks, meaning a lower monthly mortgage payment.

And the only way you could access their wholesale rates was through a mortgage broker.

These days, there’s also the option of going through a nonbank lender that doesn’t have physical branches or offer deposit accounts, which may result in lower mortgage rates and fees versus banks and brokers.

Some banks and mortgage companies may overcharge you and give you the run-around, while a mortgage broker may do an excellent job and secure a lower mortgage rate for you.

Real estate agents will typically refer you to their preferred bank, broker, or loan officer.

You are under no obligation to use them, though they can be helpful to quickly get through the mortgage preapproval process.

One benefit of using a broker is that the experience is probably a lot more consistent because it’s just one person (and their team), as opposed to a large bank with thousands of employees.

Brokers are easy to get someone on the phone or speak in person if you so desire.

Most of them provide personal service, meaning you’ll have a direct phone number to reach them, and can even visit them in their office if you have questions. You might not find the same level of service at the big banks…

1702 Woodend Drive

Indian Trail, NC 28079

Edge Home Finance Corp, is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. Edge Home Finance Corp is a licensed mortgage broker in the following states CA, CO, FL, MN, NC, ND, WI and TX. The following states require disclosure of licensing information. (If your state is not listed, it does not require a specific license disclosure):

CALIFORNIA – Licensed by the Department of Business Oversight under California Finance Lenders Law

COLORADO – Edge Home Finance Corp, 4530 W 77th St Suite 365 Edina, MN 55435, (763) 219-8484; to check the license status of your mortgage broker, visit http://www.dora.state.co.us/real-estate/index.htm

TEXAS – CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV

Your information will be used for the sole purpose of providing your home report.

Your information will not be sold to any party outside of this product.

Opt Out At Anytime